Login Internet Banking

Personal/Private Banking Business Register NowPersonal Internet Banking

Anytime, anywhereWith ICBC (Asia) Internet Banking service ("Internet Banking"), you are able to access our comprehensive range of financial and investment solutions through Internet anytime, anywhere. Moreover, you can enjoy more with various exclusive offers. |

Descriptive Information |

Feature & Advantage

| Items | Via Internet Banking | Via Branches | Internet Banking Bonus Offer | |

| Investment Services* | Brokerage Commission | Private Banking 0.10% |

General Customers1 0.25% |

General Customers save 0.1%of the brokerage fee |

|---|---|---|---|---|

| "Elite Club" Account 0.125% |

||||

| "e-Age Banking" Account 0.138% |

||||

| General Customers 0.15% |

||||

| Free Online Real Time Quote | Private Banking unlimited | Only Available online | Private Banking unlimited | |

| "Elite Club" Account 500 free online real time quotes per month | "Elite Club" Account 500 free online real time quotes per month | |||

| "e-Age Banking" Account 400 free online real time quotes per month | "e-Age Banking" Account 400 free online real time quotes per month | |||

| General Customers 300 free online real time quotes per month | General Customers 300 free online real time quotes per month | |||

| Remittance Services | Outward Payment To Other Local Banks By CHATS | HK$50 | As low as HK$1502 | At least save HK$100 |

| Telegraphic Transfer(Remittance To Branches of ICBC Group) | HK$100 | As low as HK$1502 | At least save HK$50 | |

| Telegraphic Transfer(Remittance To Branches of non-ICBC Group) | HK$140 | As low as HK$2002 | At least save HK$60 | |

| ICBC Express(Express HKD & USD Payment Remit To Branches of ICBC Group) | HK$80 | As low as HK$1502 | At least save HK$70 | |

| Telegraphic Transfer To Mainland China(Remittance In RMB To Branches of ICBC Group) | HK$100 | As low as HK$1502 | At least save HK$50 | |

| Telegraphic Transfer To Mainland China(Remittance In RMB To Branches of non-ICBC Group) | HK$140 | As low as HK$2002 | At least save HK$60 | |

Remarks:

- The table above sets out the brokerage commission for transaction amount per trade below HK$300,000 via branches. The bonus offered by branches will be different in accordance with the types of customer and transaction amount. Customers can visit our branch for the details.

- This is the basic charge for refenence only. The actual charge of remittance services via branches will be different due to the need of other remittance-related services. Customers can visit our branch for the details.

(1) Comprehensive features

We have more than 100 features including remittance, investment, currency exchange, loan applications, bill payment, insurance, credit cards, market information, information tips, account management and many other features. Each of the main features have sub-features and they can fully meet your financial needs.

(2) ICBC Remittance at a Glance

ICBC Remittance service is tailored for customers with ICBC accounts in Mainland China ("ICBC Account"). This service does not only allow customer to remit funds to ICBC Account, but also transfer funds within our bank, to other HK and overseas banks. You can also pre-register the ICBC Account as beneficiary account.

(3) Proficient in Investment Service

You can enjoy our online Securities Trading services to catch each investment opportunity with our stock quotes, price alert and market information. You can also online open an investment account to conduct the stock trading, monthly stock saving plan, investment funds, e-IPO, bonds trading and purchase of Certificate of Deposit (IPO).

(4) Global Account Management

You can submit the remittance application 24 hours a day through our Internet Banking. Together with our network of over 27 overseas branches in U.S., UK, Japan, Singapore and Malaysia etc., these is no time and geographical boundary for your financial management worldwide.

(5) ICBC Account EasyAccess

Your ICBC account in China could be connected with the Internet Banking. Just a simple log in, you can access the account balance, same day transaction details and historical transaction details of your ICBC account in China. You can just stay in Hong Kong to manage your accounts of two different geographical areas with ease.

(6) Enjoy Exclusive Offers

You can enjoy more than 10 special offers through our Internet Banking. In particular, submission of outward remittance to worldwide branches of ICBC is more preferential than that to other overseas bank. Fund transfer to other local banks through electronic clearing service is even free of charge. We will keep introducing more and more benefits to our Internet Banking customers from time to time.

(1) Account Enquiry

You can enquire the balance and the latest transaction details for the previous 180 days of all your HKD, RMB and multi-currency accounts. You can also download the information for easy reference.

(2) Investment Tools

You can set the unit price within 200 spreads from the nominal bid/ask price. Your brokerage fee will be further saved by enjoying our combined orders of your buying or selling same stock twice or more on the same day. Your transaction will be completed immediately with the support of our third generation of the Automatic Order Matching and Execution System (AMS/3).

(3) Online Account Opening

Now you can online open the ICBC (Asia) accounts anytime, anywhere. You can open up to 9 types of accounts through our Internet Banking. They are Savings, Current, Time deposit, Securities, Investment Funds, Bonds and Structured Products accounts.

(4) "ICBC (Asia) Messaging" Service

"ICBC (Asia) Messaging" Service is an information alert service that allows you to grasp your accountˇs status more efficiently and more comprehensively. You can flexibly set up SMS and Email Alerts for your account information. The SMS and Email will be sent immediately when there is movement in your account, including inward/outward payment, cheque deposit/return and due repayment etc.

(5) Autopay - Standing Instruction Request

You can pre-set the standing instructions automatically on weekly, monthly or even yearly basis through the Internet Banking. The implementation of the instruction and the date of execution would be processed by the system automatically. Your regular financial needs can be handled at ease.

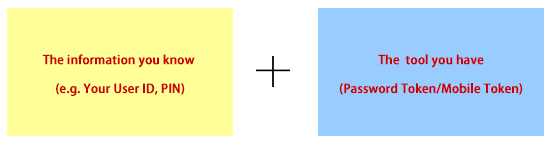

(1) Two-factor Authentication to Strengthen Security

The Two-factor authentication uses a combination of 2 different factors for verifying a userˇs identity:

Advantage of Two-factor Authentication:

Your transaction is highly protected because the fraudsters cannot steal your physically possessed tools (such as your password token) over the Internet. All of the high-risk Internet Banking transactions, such as fund transfers to non-designated accounts, are protected by this additional authentication tool physically held by yourself. By just a few simple steps, you can enjoy this enhanced security level of online transactions.

(2) How to use Two-factor Authentication?

Press the password token to get the one-time password. When you conduct a high risk transaction, you should use the password from password token. Then you can type the one-time password to confirm your transaction. Click here to read the manual of Password Token / Mobile Token Operation Manual.

(3)Security Tips

After you have finished all online transactions, you must remember to click "Logout" to exit from the Internet Banking system to avoid any information leaking. Please safeguard your password token because it is an important tool for two-factor authentication. Do not access Internet Banking through hyperlinks embedded in e-mails. Please be aware that we will never request or ask you for account number, PIN or any personal information through e-mails. To enhance your Internet Banking account safety, the Internet Banking service will be suspended immediately if it is attempted with invalid PIN for 4 times consecutively. In this case, you can visit any of our branches for regeneration of new password.See more about Security Tips and Two-factor authentication.

(4) Review of Registered Third Party Accounts

Before your registration of third party's account(s) which is of high risk categories (e.g. money service operator or agent that provides services or products that can be easily converted to money such as remittance agent, money changer, jewellery companies, casino, finance/loans related service such as stock agents, credit card merchants) for fund transfer, please consider carefully and read the Bank's online security tips. Please be aware of the potential risk of registering third-party accounts of some institutions which may be used for retrieving funds or transferring funds to another non-designated beneficiary.

Please go to http://www.icbcasia.comand select "Personal/Securities" at left and click "Go". To access the Internet Banking, please enter your Internet Banking A/C No./ Defined User Name and Internet Banking Login PIN. If it is the first time to login our Internet Banking, please read and accept the Terms and Conditions, then change your Login PIN. The DNS of Internet banking is icbc.com.cn

Back to top1. If you have not become our customer:

(1) Local customer -please bring your "Identity documents such as HK Identity Card" and"Latest address proof issued within 3 months";

(2) Mainland customer -please bring your "PRC Identity Card " plus"Multiple journey "Tanqin"" or"PRC Passport (if any)" ;

Go to our branch to open a HKD account and register our Internet Banking services, which will be effective on the same day.

2. If you are our bank customer with ATM Card, Phone Banking account or Credit Card, you can operate your bank accounts through Internet Banking by simply completing several steps for online registration. Please access our Internet Banking login page and click  to become our Personal Internet Banking customer to enjoy the convenience of Internet Banking service. For details, please click here. Back to top

to become our Personal Internet Banking customer to enjoy the convenience of Internet Banking service. For details, please click here. Back to top

Service Applicable to

Personal customers

Account Opening Conditions

Personal customers can open ICBC (Asia) Internet Banking Services with any of your savings/current account or credit card.

Steps for Registration

Please refer to ICBC (Asia) Internet Banking Account Opening Procedure

Service Hour & Channel

Internet banking enquiry function provides 24-hour service. Please refer to transaction tips in the internet banking for the services hours of other functions.

Daily Maximum Limit of Funds Transfer

The daily maximum limit of funds transfer, are as follows:

|

Transaction Type

|

Personal Account (Maximum limit)

|

| Same Party Pre-registered Account Transfer (Including purchase of Cashier's Order and Demand Draft to be collected by account holder at designated branch) |

Unlimited |

| Pre-registered Third Party Account Transfer (Including transfer within our bank accounts and transfer to other bank accounts) |

Total daily limit: HKD1,000,000 ae Customer can further define the individual transfer limit per Pre-registered account upon application - For CNY Telegraphic transfer, the maximum total daily limit is CNY80,000 per customer which is only applicable for Personal Account at the moment Please note that CNY transfer has to meet the regulatory requirements for the beneficiary bank country. If not, it may cause a refund and leads to other charges. |

| Non-registered Third Party Account Transferb (Including transfer within our bank accounts and transfer to other bank accounts) |

For Two-Factor Authentication users: HKD200,000 c Zero amount for Non Two-Factor Authentication users |

| General Bill Payment (Including all bill payments, credit card payments and donations) |

HKD500,000ae |

| Tax Payment | HKD500,000ae |

| White Form eIPO Online Payment | HKD4,000,000 a |

| Small-Value Fund Transfer (per day)de | Application via branch: HKD10,000 Application via Internet Banking: HKD10,000 |

| Currency Exchange Currency exchange Between HKD and USD |

HK500,000,000 or its equivalent |

|

HKD50,000,000 or its equivalent |

| Currency exchange Between HKD and SGD |

HKD50,000,000 and its equivalent |

| Currency exchange Between HKD and RMB |

HKD50,000,000 and its equivalent |

a. Customer can define the transfer limit upon application, and the customer can also adjust the transfer limit via Internet (Password token will be required for increasing the transfer limit).

b. Applicable to Small-Value Fund Transfer.

c. Please note that this limit will be reset to “Zero” if you have not performed a fund transfer to a non-registered 3rd party account via Internet Banking for 12 months. To reset the related transfer limit, you may submit your request via token or visit any of our branches.

d. Small-value Fund Transfer service allows you to submit a transaction instruction to non-registered 3rd party account without token authentication.

e.The limits are shared between Intenet Banking and Mobile Banking.

Important Notice

If you forget your internet banking password, you can reset it via any ICBC (Asia) Branch.

Risk Disclosure and Reminder

- Investment involves risk and the prices of securities and derivatives products fluctuate. The prices of securities may move up or down, sometimes dramatically, and may become valueless.

- It is as likely that loss will be incurred rather than profit made as result of buying and selling investment. Past result should not be taken as indication of future performance.

- The risk of loss in financing a transaction by deposit of collateral is significant. You may sustain losses in excess of your cash and any other assets deposited as collateral with the licensed or registered person. You may be called upon at short notice to make additional margin or interest payments. If the required margin or interest payments are not made within the prescribed time, your collateral may be liquidated without your consent. Moreover, you will remain liable for any resulting deficit in your account and interest charged on your account.

- Before making investment decision, you should thoroughly study the offering documents; the financial reports and relevant risk disclosure statements issued by the issuer of the investment product(s). Further you should consider your own circumstances and financial position to ensure the investment are suitable for your particular investment needs.

- You shall seek independent professional advice on legal, tax, financial and other issues in connection with the investment if necessary.

- Keep your password secure and secret at all times, and change your password periodically.

- Please safeguard your password, or you may suffer loss of personal information or assets.